Financial Assistance

Focus: Small to mid-size businesses

Developing and fostering public/private partnerships to grow the local economy.

Financial Assistance

Focus: Small to mid-size businesses

Developing and fostering public/private partnerships to grow the local economy.

Jump to a section:

Jump to a section:

About Financial Assistance

EDGE focuses on developing and fostering public/private partnerships to create jobs, grow the local economy, revitalize neighborhoods, attract investment, spark innovation, and encourage entrepreneurship.

Contact an Economic Development Specialist at:

901.341.2100

About Financial Assistance

EDGE focuses on developing and fostering public/private partnerships to create jobs, grow the local economy, revitalize neighborhoods, attract investment, spark innovation, and encourage entrepreneurship.

Contact an Economic Development Specialist at:

901.341.2100

About Financial Assistance

EDGE focuses on developing and fostering public/private partnerships to create jobs, grow the local economy, revitalize neighborhoods, attract investment, spark innovation, and encourage entrepreneurship.

Contact an Economic Development Specialist at:

901.341.2100

ICED Loan

FAQs

ICED loan funds are primarily for building façade improvements and streetscape improvements.

Interior improvements and building expansions may also be eligible.

Funding for the ICED loan program is generated through special City of Memphis and Shelby County Payment-In-Lieu-of- Tax (PILOT) personal property fees.

Projects are approved by the EDGE Economic Development Finance Committee

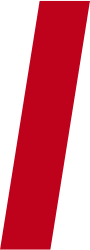

Inner City Economic Development (ICED) Loans

The Inner City Economic Development (ICED) Loan program is designed to spark revitalization of Memphis inner city neighborhood business districts through small forgivable loans (up to $25,000).

Since 2014, the ICED Loan program has assisted projects that have invested nearly…

in Memphis's Inner City Neighborhoods

ICED Loan

FAQs

ICED loan funds are primarily for building façade improvements and streetscape improvements.

Interior improvements and building expansions may also be eligible.

Funding for the ICED loan program is generated through special City of Memphis and Shelby County Payment-In-Lieu-of- Tax (PILOT) personal property fees.

Projects are approved by the EDGE Economic Development Finance Committee

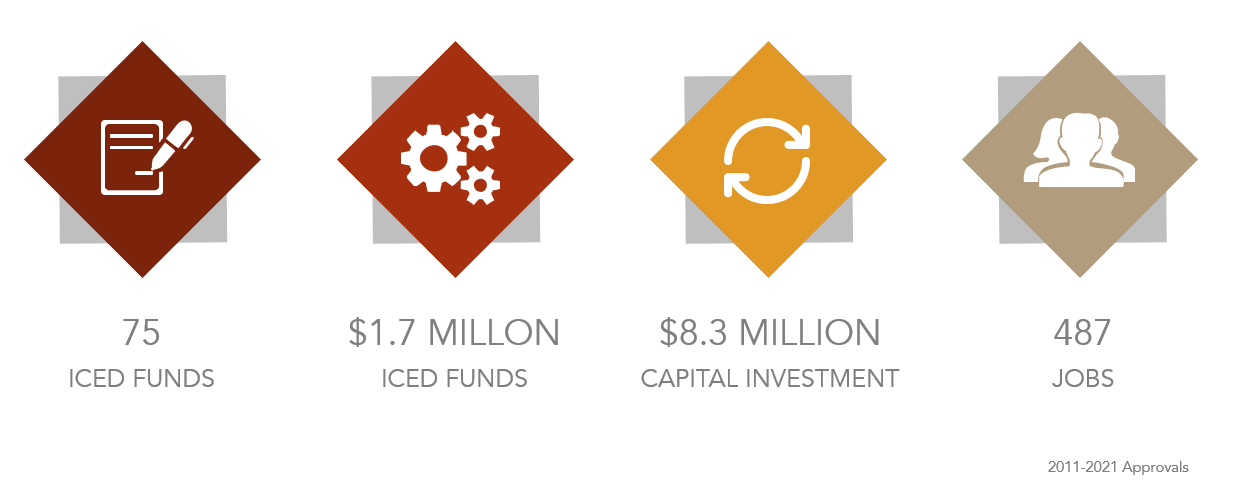

Inner City Economic Development (ICED) Loans

The Inner City Economic Development (ICED) Loan program is designed to spark revitalization of Memphis inner city neighborhood business districts through small forgivable loans (up to $25,000).

Since 2014, the ICED Loan program has assisted projects that have invested nearly…

in Memphis's Inner City Neighborhoods

View ICED Loan Featured Project

ICED Loan Program Eligibility

Businesses and property owners that meet the following criteria may be eligible to apply for an ICED loan:

Read More

- The building must be located in a New Markets Tax Credit eligible census tract.

- City of Memphis and Shelby County property taxes must be current or an approved payment plan must be in place.

- The applicant must have sufficient capital to fund one-third of approved construction costs and complete the entire project without impacting the business negatively.

- Both building owners and tenants with a three-year lease are eligible.

- Priority will be given to neighborhood serving businesses with transparent storefront windows facing the street.

Project Assistance

Applicants are required to meet with EDGE staff to facilitate the loan process and construction projects.

Read More

- An architect retained by EDGE is available to assist the applicant with elevations and budget estimates for presentation to the EDGE Finance Committee as part of the application review process.

- The applicant will meet with the EDGE staff to review building and desired improvements.

Ineligible Businesses

The following business categories as defined in the Memphis and Shelby County Unified Development Code, are not eligible for forgivable loans under the ICED loan program:

Read More

- Liquor and tobacco stores

- Adult entertainment and product stores

- Pawnshops, payday loan/title loan establishments

- Mini-storage facilities

- Auto dealerships

More Info & Application

View IRB Featured Project

Taxable & Tax-Exempt Industrial Revenue Bonds

EDGE is authorized by state statute to issue taxable and tax-exempt bonds for financing commercial, non-profit and government facilities. As a “conduit” bond issuer, EDGE has no responsibility for principal or interest payments due on any bonds issued. The beneficiary is responsible for the placement/sale of the bonds and their repayment.

The financial strength of the borrower at the time the bonds are taken to market will determine the rate of the bonds.

EDGE is prepared to act quickly on an application: